Text Mining

Part 1: to be completed at home before the lab

During this practical, we will cover an introduction to text mining. Topics covered are how to pre-process mined text (in both the tidy approach and using the tm package), different ways to visualize this mined text, creating a document-term matrix and an introduction to one type of analysis you can conduct during text mining: text classification. As a whole, there are multiple ways to mine & analyze text within R. However, for this practical we will discuss some of the techniques covered in the tm package and in the tidytext package, based upon the tidyverse.

You can download the student zip including all needed files for this lab here.

Note: the completed homework has to be handed in on Black Board and will be graded (pass/fail, counting towards your grade for individual assignment). The deadline is two hours before the start of your lab. Hand-in should be a PDF file. If you know how to knit pdf files, you can hand in the knitted pdf file. However, if you have not done this before, you are advised to knit to a html file as specified below, and within the html browser, ‘print’ your file as a pdf file.

For this practical, you will need the following packages:

# General Packages

library(tidyverse)

# Text Mining

library(tidytext)

library(gutenbergr)

library(SnowballC)

library(wordcloud)

library(textdata)

library(tm)

library(stringi)

library(e1071)

library(rpart)For the first part of the practical, we will be using text mined through the Gutenberg Project; briefly this project contains over 60,000 freely accessible eBooks, which through the package gutenberger, can be easily accessed and perfect for text mining and analysis.

We will be looking at several books from the late 1800s, in the mindset to compare and contrast the use of language within them. These books include:

- Alice’s Adventures in Wonderland by Lewis Carroll

- The Picture of Dorian Gray by Oscar Wilde

- Magic of Oz by Frank Lyman Baum

- The Strange Case of Dr. Jekyll and Mr. Hyde by Robert Louis Stevenson

Despite being old books, they are still popular and hold cultural significance in TV, Movies and the English Language. To access this novel suitable for this practical the following function should be used:

AAIWL <- gutenberg_download(28885) # 28885 is the eBook number of Alice in Wonderland

PODG <- gutenberg_download(174) # 174 is the eBook number of The Picture of Dorian Gray

MOz <- gutenberg_download(419) # 419 is the eBook number of Magic of Oz

SCJH <- gutenberg_download(43) # 43 is the eBook number of Dr. Jekyll and Mr. HydeAfter having loaded all of these books into your working directory (using the code above), examine one of these books using the View() function. When you view any of these data frames, you will see that these have an extremely messy layout and structure. As a result of this complex structure means that conducting any analysis would be extremely challenging, so pre-processing must be undertaken to get this into a format which is usable.

Pre-Processing Text: Tidy approach

In order for text to be used effectively within statistical processing and analysis; it must be pre-processed so that it can be uniformly examined. Typical steps of pre-processing include:

- Tokenization

- Removing numbers

- Converting to lowercase

- Removing stop words

- Removing punctuation

- Stemming

These steps are important as they allow the text to be presented uniformly for analysis (but remember we do not always need all of them); within this practical we will discuss how to undergo some of these steps.

Step 1: Tokenization, un-nesting Text

When we previously looked at this text, as we discovered it was extremely messy with it being attached one line per row in the data frame. As such, it is important to un-nest this text so that it attaches one word per row.

Before un-nesting text, it is useful to make a note of aspects such as the line which text is on, and the chapter each line falls within. This can be important when examining anthologies or making chapter comparisons as this can be specified within the analysis.

In order to specify the line number and chapter of the text, it is possible to use the mutuate function from the dplyr package.

- Apply the code below, which uses the

mutatefunction, to add line numbers and chapter references one of the books. Next, use theView()function to examine how this has changed the structure.

# Template, replace BOOKNAME with the name of the book:

tidy_[BOOKNAME] <- [BOOKNAME] %>%

mutate(linenumber = row_number(),

chapter = cumsum(str_detect(text, regex("^chapter [\\divxlc]",

ignore_case = TRUE))))# Answers

tidy_AAIWL <- AAIWL %>%

mutate(linenumber = row_number(),

chapter = cumsum(str_detect(text, regex("^chapter [\\divxlc]",

ignore_case = TRUE))))

tidy_PODG <- PODG %>%

mutate(linenumber = row_number(),

chapter = cumsum(str_detect(text, regex("^chapter [\\divxlc]",

ignore_case = TRUE))))

tidy_MOz <- MOz %>%

mutate(linenumber = row_number(),

chapter = cumsum(str_detect(text, regex("^chapter [\\divxlc]",

ignore_case = TRUE))))

tidy_SCJH <- SCJH %>%

mutate(linenumber = row_number(),

chapter = cumsum(str_detect(text, regex("^chapter [\\divxlc]",

ignore_case = TRUE))))View(tidy_AAIWL)

View(tidy_PODG)

View(tidy_MOz)

View(tidy_SCJH)From this, it is now possible to pass the function unnest_tokens() in order to split apart the sentence string, and apply each word to a new line. When using this function, you simply need to pass the arguments, word (as this is what you want selecting) and text (the name of the column you want to unnest).

- Apply unnest_tokens to your tidied book to unnest this text. Next, once again use the

View()function to examine the output.

Hint: As with Question 1, ensure to use the piping operator (%>%) to easily apply the function.

tidy_AAIWL <- tidy_AAIWL %>%

unnest_tokens(word, text)

tidy_PODG <- tidy_PODG %>%

unnest_tokens(word, text)

tidy_MOz <- tidy_MOz %>%

unnest_tokens(word, text)

tidy_SCJH <- tidy_SCJH %>%

unnest_tokens(word, text)This results in one word being linked per row of the data frame. The benefit of using the tidytext package in comparison to other text mining packages, is that this automatically applies some of the basic steps to pre-process your text, including removing of capital letters, inter-word punctuation and numbers. However additional pre-processing is required.

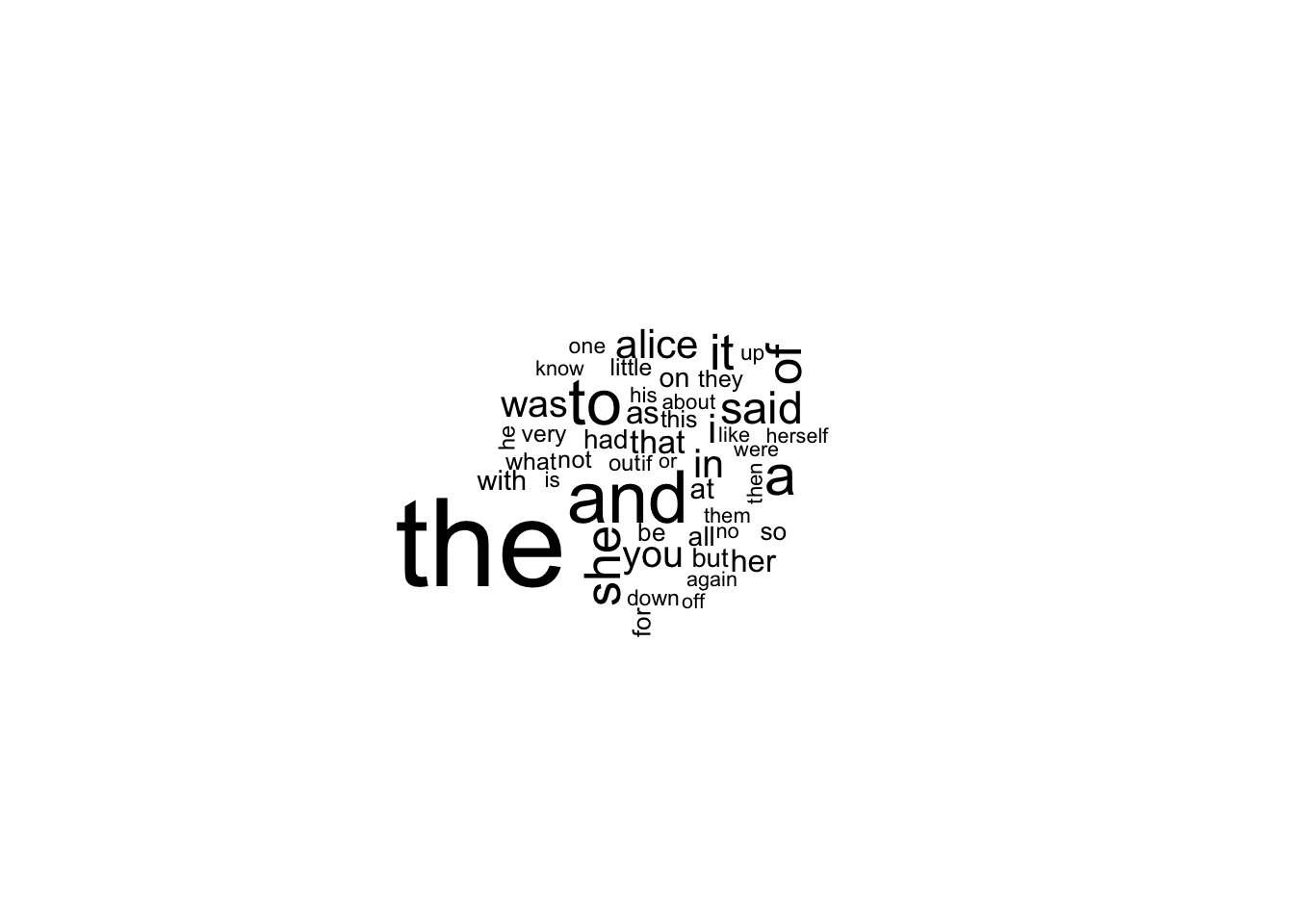

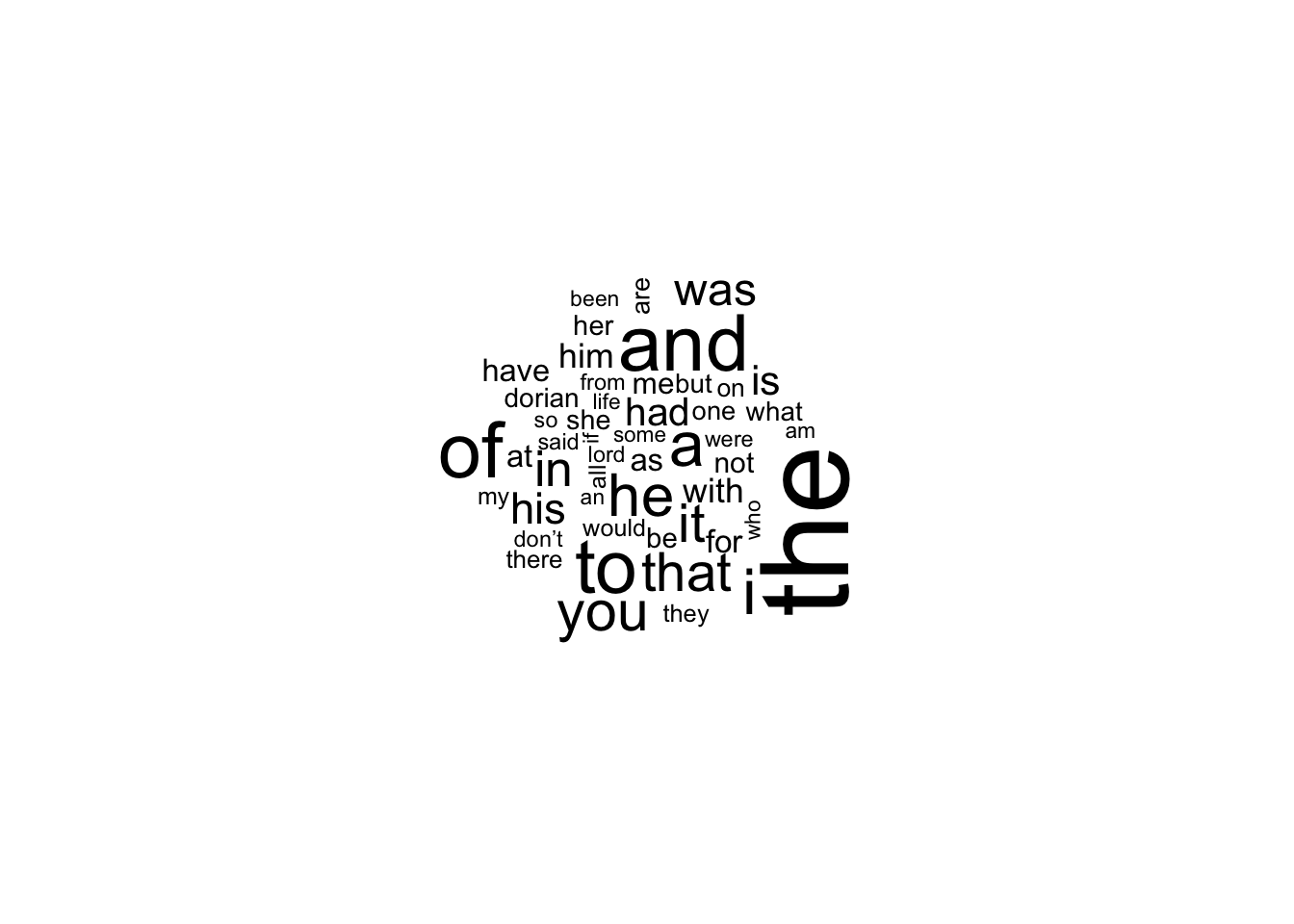

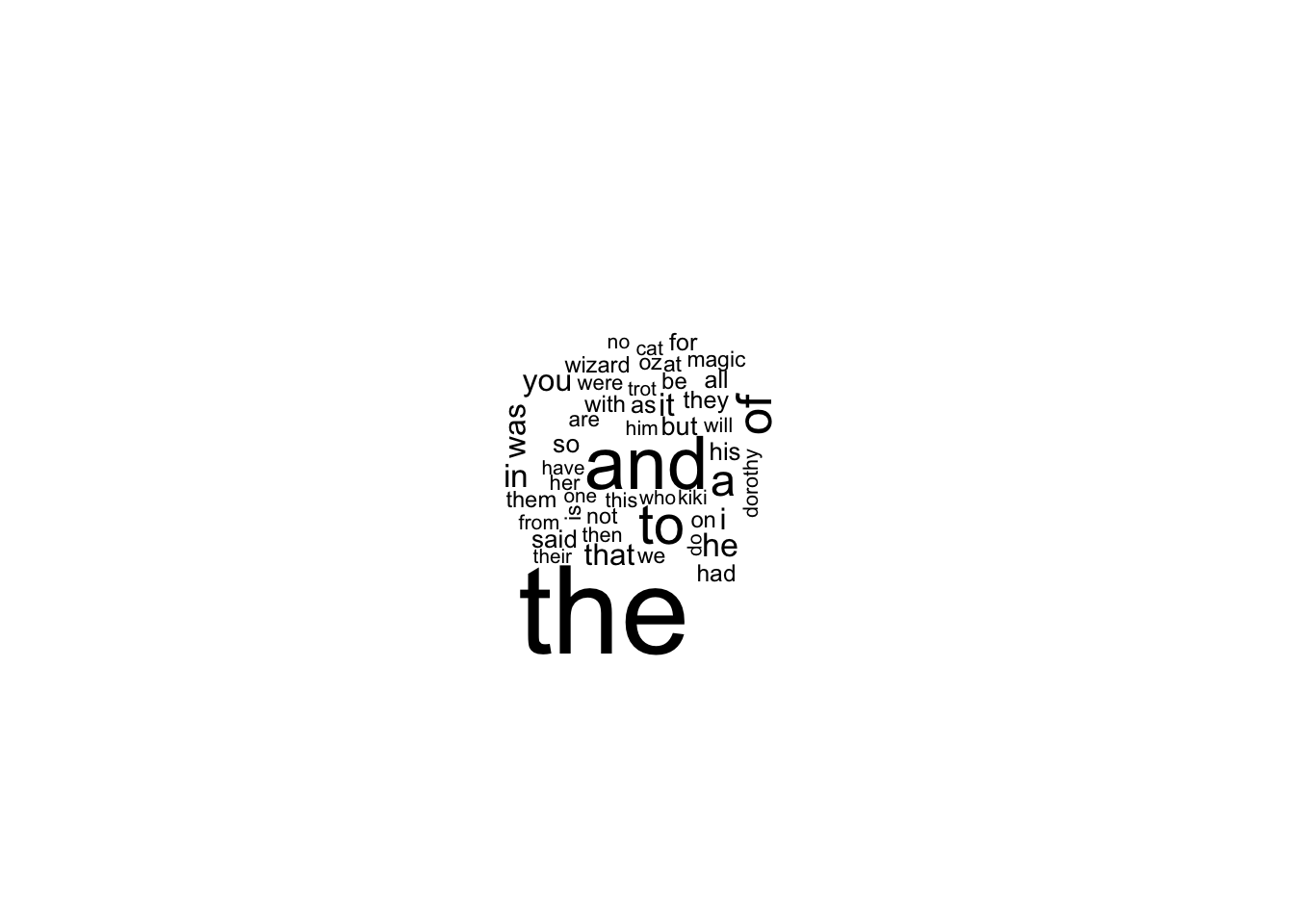

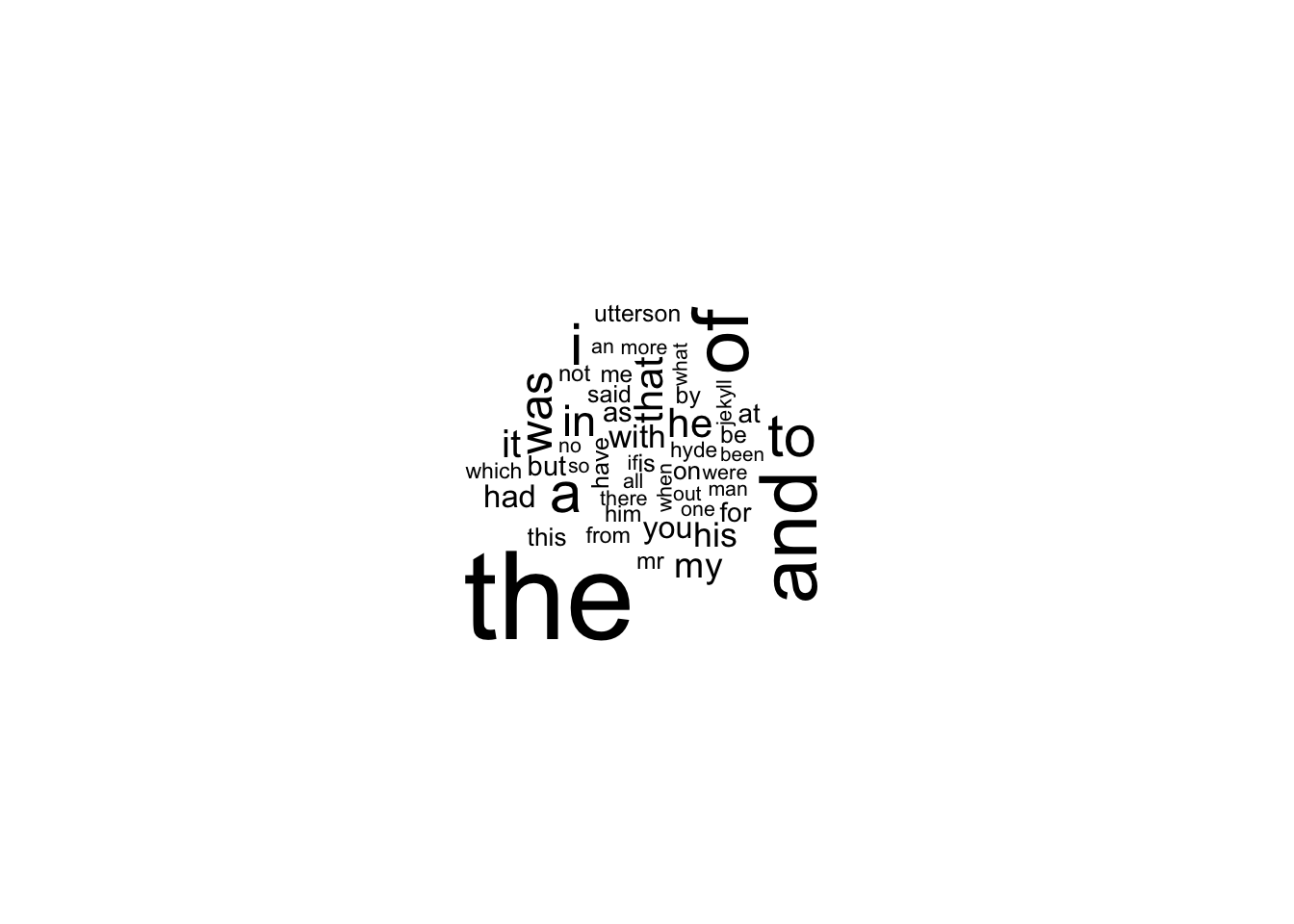

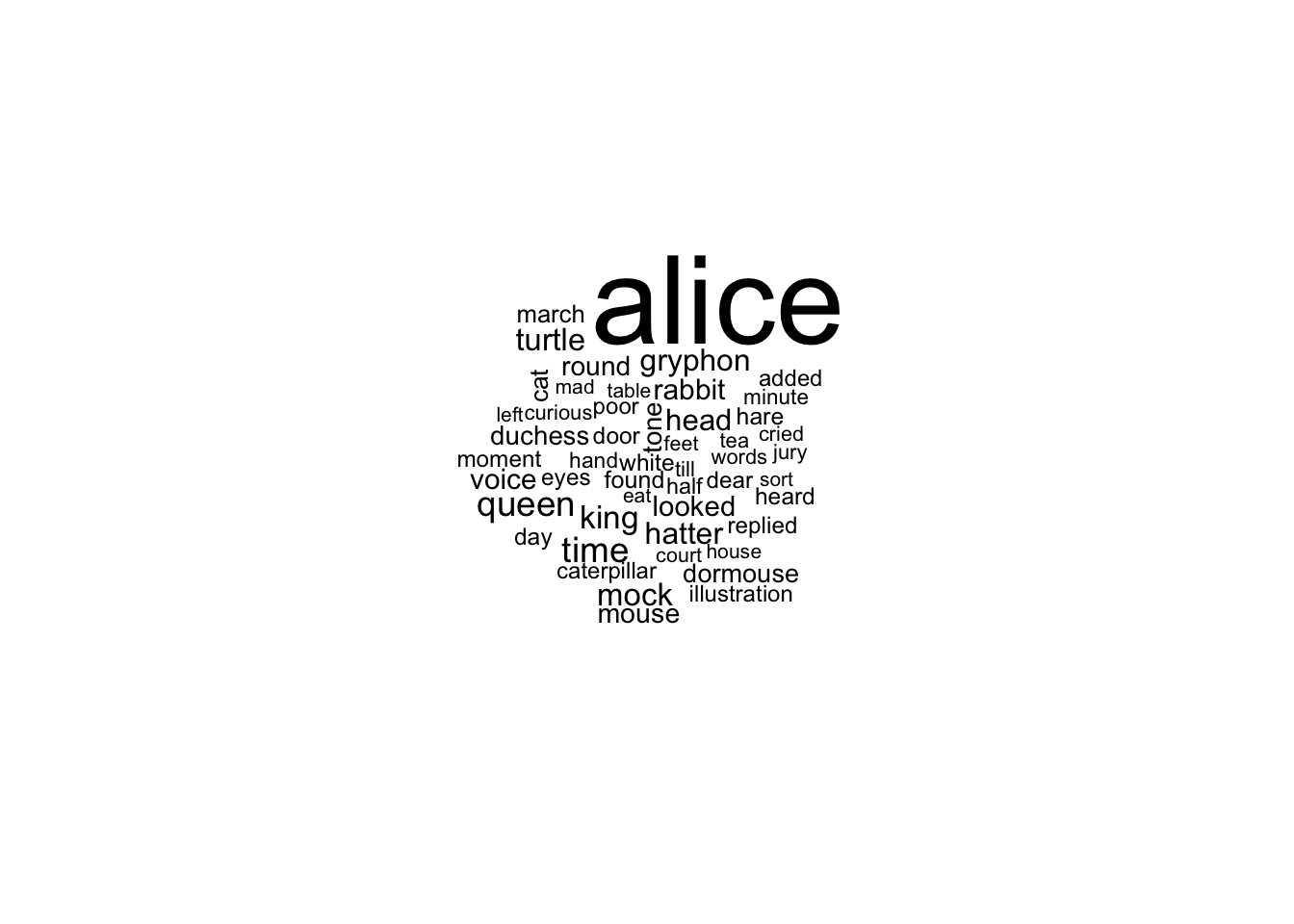

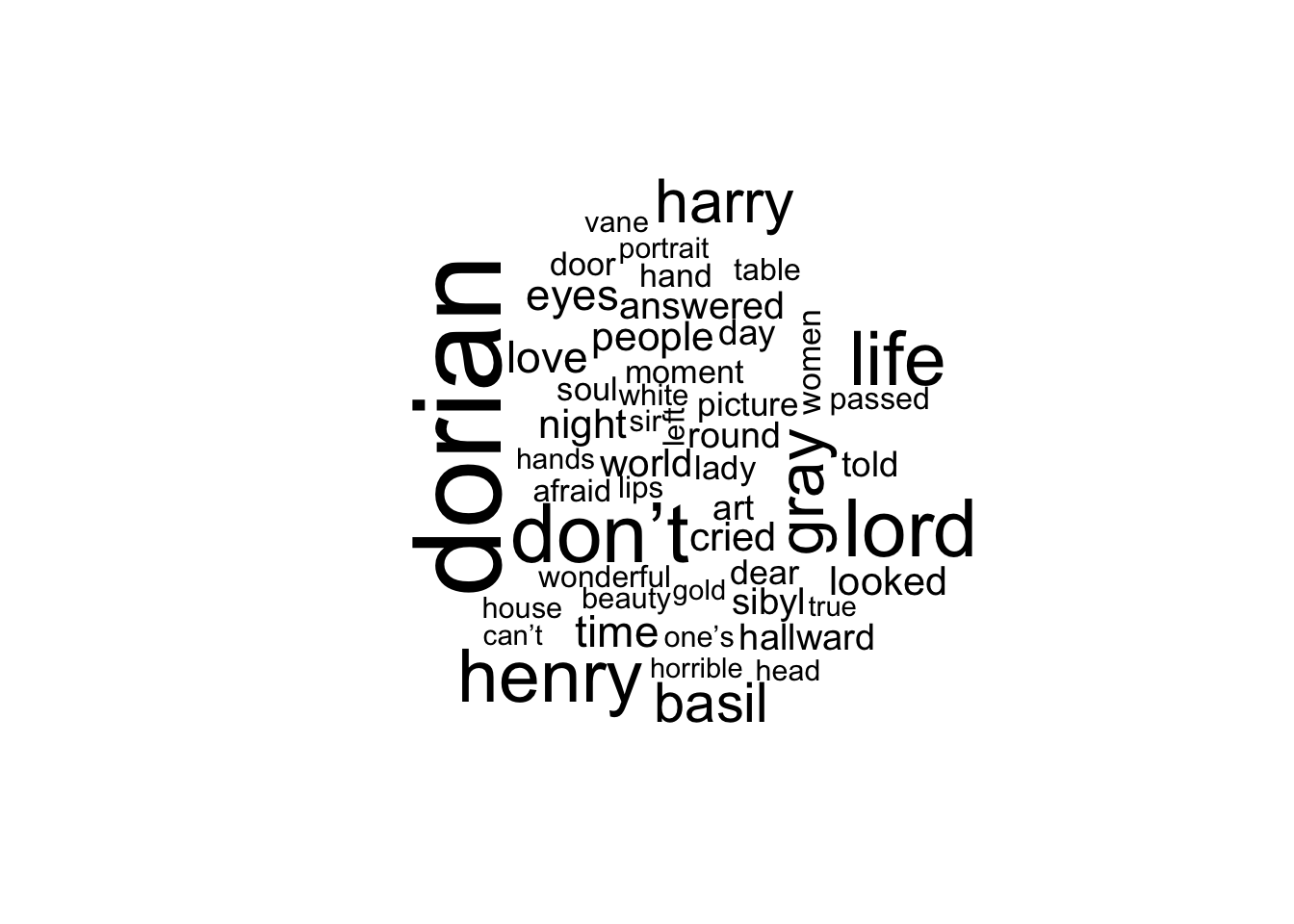

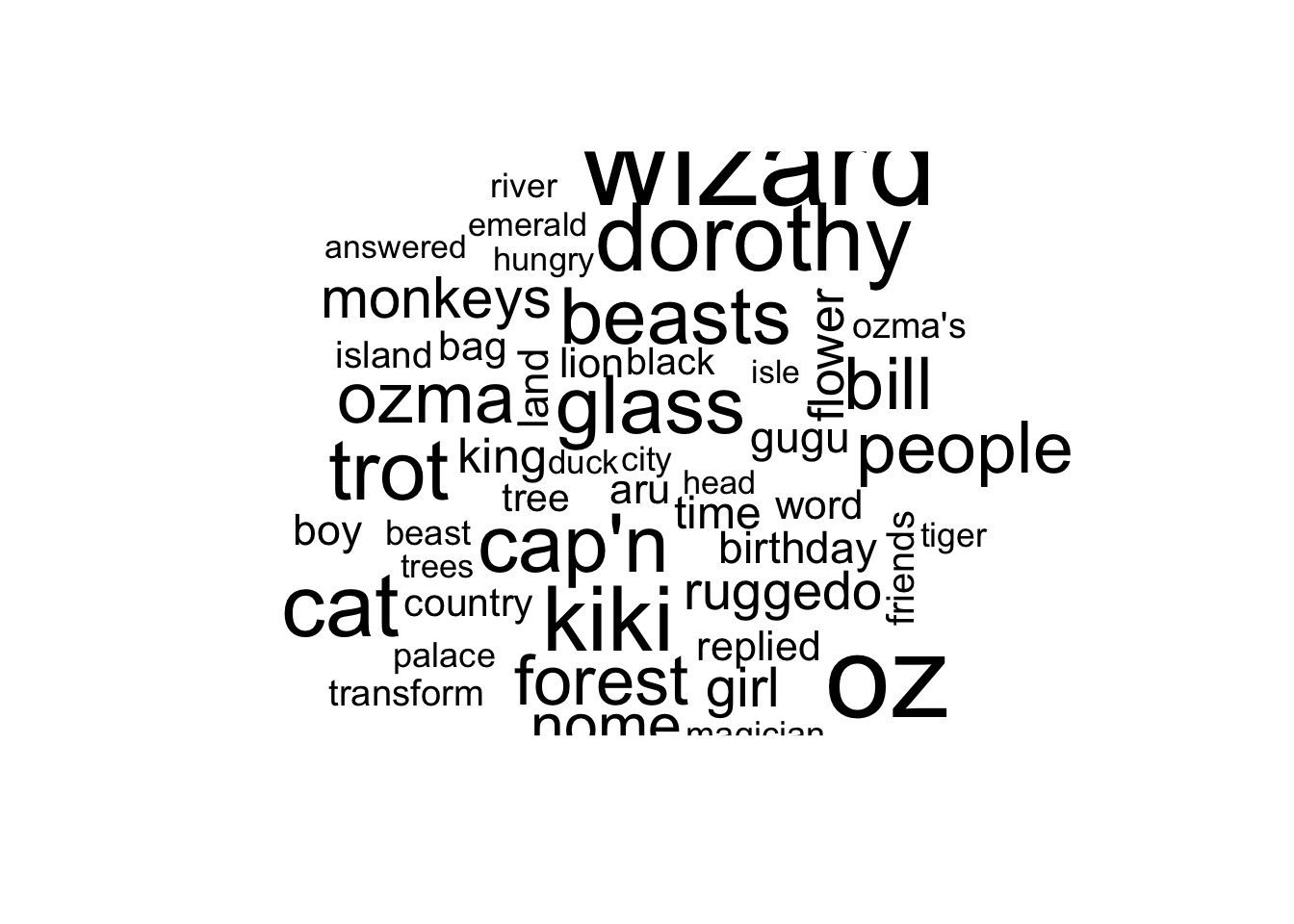

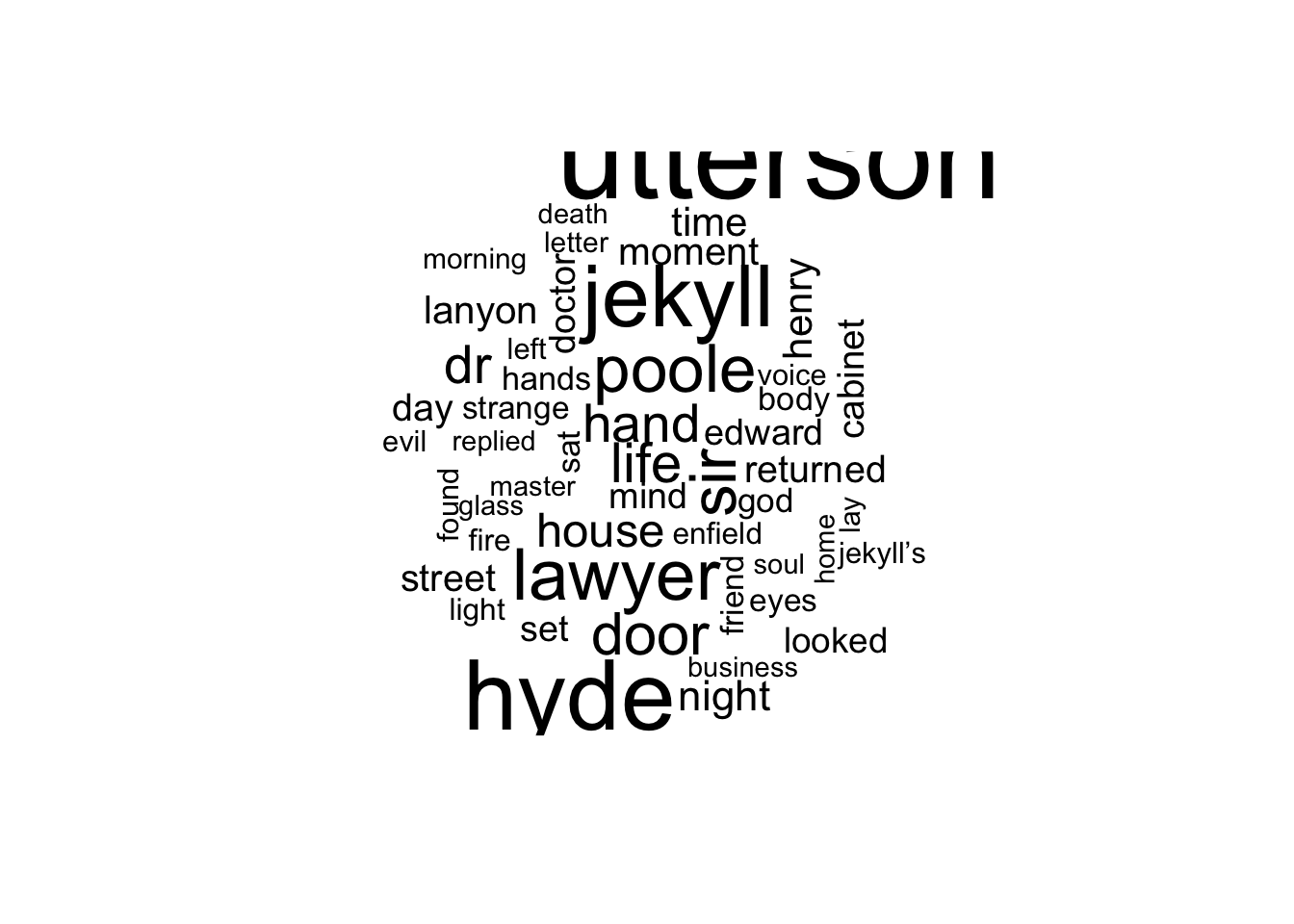

Intermezzo: Word clouds

Before continuing the pre-processing process, let’s have a first look at our text by making a simple visualization using word clouds. Typically these word clouds visualize the frequency of words in a text through relating the size of the displayed words to frequency, with the largest words indicating the most common words.

To plot word clouds, we first have to create a data frame containing the word frequencies.

- Create a new data frame, which contains the frequencies of words from the unnested text. To do this, you can make use of the function

count().

Hint: As with Question 1, ensure to use the piping operator (%>%) to easily apply the function.

tidy_AAIWL.count <- tidy_AAIWL %>%

count(word, sort = TRUE)

tidy_PODG.count <- tidy_PODG %>%

count(word, sort = TRUE)

tidy_MOz.count <- tidy_MOz %>%

count(word, sort = TRUE)

tidy_SCJH.count <- tidy_SCJH %>%

count(word, sort = TRUE)

# note that the use of 'sort = TRUE' is not strictly neccesary here.- Using the

wordcloud()function, create a word cloud for your book text. Use the argumentmax.wordswithin the function to set the maximum number of words to be displayed in the word cloud.

Hint: As with Question 1, ensure to use the piping operator (%>%) to easily apply the function.

Note: Ensure to use the function with(), is used after the piping operator.

tidy_AAIWL.count %>%

with(wordcloud(word, n, max.words = 50))

tidy_PODG.count %>%

with(wordcloud(word, n, max.words = 50))

tidy_MOz.count %>%

with(wordcloud(word, n, max.words = 50))

tidy_SCJH.count %>%

with(wordcloud(word, n, max.words = 50))

- Can you easily tell what text each word clouds come from, based on the popular words which occur?

#No, we can't understand what book each word cloud came from. We notice that for all the word clouds the most frequent words are some stop words (such as and, the, of)Part 2: to be completed during the lab

Pre-Processing Text: Tidy approach - continued

Step 2: Removing stop words

As discussed within the lecture, stop words are words in any language which have little or no meaning, and simply connect the words of importance. Such as the, a, also, as, were… etc. To understand the importance of removing these stop words, we can simply do a comparison between the text which has had them removed and those which have not been.

To remove the stop words, we use the function anti_join(). This function works through un-joining this table based upon the components, which when passed with the argument stop_words, which is a table containing these words across three lexicons. This removes all the stop words from the presented data frame.

- Use the function

anti_join()to remove stop words from your tidied text attaching it to a new data frame.

Hint: As with Question 1, ensure to use the piping operator (%>%) to easily apply the function.

tidy_AAIWL.2 <- tidy_AAIWL %>%

anti_join(stop_words)

tidy_PODG.2 <- tidy_PODG %>%

anti_join(stop_words)

tidy_MOz.2 <- tidy_MOz %>%

anti_join(stop_words)

tidy_SCJH.2 <- tidy_SCJH %>%

anti_join(stop_words)In order to examine the impact of removing these filler words, we can use the count() function to examine the frequencies of different words. This when sorted, will produce a table of frequencies in descending order. An other option is to redo the wordclouds on the updated data frame containing the word counts of the tidied book text without stop words.

- Use the function

count()to compare the frequencies of words in the dataframes containing the tidied book text with and without stop words (usesort = TRUEwithin thecount()function), or redo the wordclouds. Do you notice a difference in the (top 10) words which most commonly occur in the text?

Hint: As with Question 1, ensure to use the piping operator (%>%) to easily apply the function.

tidy_AAIWL.count2 <- tidy_AAIWL.2 %>%

count(word, sort = TRUE)

tidy_AAIWL.count## # A tibble: 2,919 × 2

## word n

## <chr> <int>

## 1 the 1676

## 2 and 899

## 3 to 757

## 4 a 649

## 5 she 543

## 6 it 539

## 7 of 523

## 8 said 466

## 9 alice 391

## 10 i 391

## # ℹ 2,909 more rowstidy_AAIWL.count2## # A tibble: 2,448 × 2

## word n

## <chr> <int>

## 1 alice 391

## 2 queen 73

## 3 time 73

## 4 king 61

## 5 mock 59

## 6 turtle 58

## 7 gryphon 55

## 8 hatter 55

## 9 head 53

## 10 rabbit 49

## # ℹ 2,438 more rowstidy_PODG.count2 <- tidy_PODG.2 %>%

count(word, sort = TRUE)

tidy_PODG.count## # A tibble: 6,909 × 2

## word n

## <chr> <int>

## 1 the 3764

## 2 and 2211

## 3 of 2175

## 4 to 2101

## 5 i 1690

## 6 a 1671

## 7 he 1539

## 8 you 1444

## 9 that 1360

## 10 it 1338

## # ℹ 6,899 more rowstidy_PODG.count2## # A tibble: 6,429 × 2

## word n

## <chr> <int>

## 1 dorian 410

## 2 don’t 255

## 3 lord 248

## 4 life 229

## 5 henry 223

## 6 gray 189

## 7 harry 174

## 8 basil 153

## 9 love 111

## 10 time 110

## # ℹ 6,419 more rowstidy_MOz.count2 <- tidy_MOz.2 %>%

count(word, sort = TRUE)

tidy_MOz.count## # A tibble: 3,585 × 2

## word n

## <chr> <int>

## 1 the 2997

## 2 and 1633

## 3 to 1112

## 4 of 930

## 5 a 826

## 6 he 486

## 7 in 471

## 8 it 461

## 9 you 429

## 10 was 421

## # ℹ 3,575 more rowstidy_MOz.count2## # A tibble: 3,093 × 2

## word n

## <chr> <int>

## 1 wizard 206

## 2 oz 194

## 3 magic 187

## 4 dorothy 152

## 5 kiki 144

## 6 cat 140

## 7 trot 131

## 8 cap'n 126

## 9 glass 126

## 10 beasts 121

## # ℹ 3,083 more rowstidy_SCJH.count2 <- tidy_SCJH.2 %>%

count(word, sort = TRUE)

tidy_SCJH.count## # A tibble: 3,982 × 2

## word n

## <chr> <int>

## 1 the 1615

## 2 and 972

## 3 of 941

## 4 to 644

## 5 i 640

## 6 a 628

## 7 was 469

## 8 in 424

## 9 he 378

## 10 that 370

## # ℹ 3,972 more rowstidy_SCJH.count2## # A tibble: 3,524 × 2

## word n

## <chr> <int>

## 1 utterson 128

## 2 hyde 98

## 3 jekyll 84

## 4 lawyer 67

## 5 poole 61

## 6 sir 59

## 7 door 52

## 8 life 48

## 9 dr 45

## 10 hand 45

## # ℹ 3,514 more rowstidy_AAIWL.count2 %>%

with(wordcloud(word, n, max.words = 50))

tidy_PODG.count2 %>%

with(wordcloud(word, n, max.words = 50))

tidy_MOz.count2 %>%

with(wordcloud(word, n, max.words = 50))

tidy_SCJH.count2 %>%

with(wordcloud(word, n, max.words = 50))

# The main difference seen is that stop words occur far more frequently,

# than any content based words. Vector space model: document-term matrix

In this part of the practical we will build a text classification model for a multiclass classification task. To this end, we first need to perform text preprcessing, then using the idea of vector space model, convert the text data into a document-term (dtm) matrix, and finally train a classifier on the dtm matrix.

The data set used in this part of the practical is the BBC News data set. You can use the provided “news_dataset.rda” for this purpose. This data set consists of 2225 documents from the BBC news website corresponding to stories in five topical areas from 2004 to 2005. These areas are:

- Business

- Entertainment

- Politics

- Sport

- Tech

- Use the code below to load the data set and inspect its first rows.

load("data/news_dataset.rda")

head(df_final)load("data/news_dataset.rda")

head(df_final)## File_Name

## 1 001.txt

## 2 002.txt

## 3 003.txt

## 4 004.txt

## 5 005.txt

## 6 006.txt

## Content

## 1 Ad sales boost Time Warner profit\n\nQuarterly profits at US media giant TimeWarner jumped 76% to $1.13bn (£600m) for the three months to December, from $639m year-earlier.\n\nThe firm, which is now one of the biggest investors in Google, benefited from sales of high-speed internet connections and higher advert sales. TimeWarner said fourth quarter sales rose 2% to $11.1bn from $10.9bn. Its profits were buoyed by one-off gains which offset a profit dip at Warner Bros, and less users for AOL.\n\nTime Warner said on Friday that it now owns 8% of search-engine Google. But its own internet business, AOL, had has mixed fortunes. It lost 464,000 subscribers in the fourth quarter profits were lower than in the preceding three quarters. However, the company said AOL's underlying profit before exceptional items rose 8% on the back of stronger internet advertising revenues. It hopes to increase subscribers by offering the online service free to TimeWarner internet customers and will try to sign up AOL's existing customers for high-speed broadband. TimeWarner also has to restate 2000 and 2003 results following a probe by the US Securities Exchange Commission (SEC), which is close to concluding.\n\nTime Warner's fourth quarter profits were slightly better than analysts' expectations. But its film division saw profits slump 27% to $284m, helped by box-office flops Alexander and Catwoman, a sharp contrast to year-earlier, when the third and final film in the Lord of the Rings trilogy boosted results. For the full-year, TimeWarner posted a profit of $3.36bn, up 27% from its 2003 performance, while revenues grew 6.4% to $42.09bn. "Our financial performance was strong, meeting or exceeding all of our full-year objectives and greatly enhancing our flexibility," chairman and chief executive Richard Parsons said. For 2005, TimeWarner is projecting operating earnings growth of around 5%, and also expects higher revenue and wider profit margins.\n\nTimeWarner is to restate its accounts as part of efforts to resolve an inquiry into AOL by US market regulators. It has already offered to pay $300m to settle charges, in a deal that is under review by the SEC. The company said it was unable to estimate the amount it needed to set aside for legal reserves, which it previously set at $500m. It intends to adjust the way it accounts for a deal with German music publisher Bertelsmann's purchase of a stake in AOL Europe, which it had reported as advertising revenue. It will now book the sale of its stake in AOL Europe as a loss on the value of that stake.

## 2 Dollar gains on Greenspan speech\n\nThe dollar has hit its highest level against the euro in almost three months after the Federal Reserve head said the US trade deficit is set to stabilise.\n\nAnd Alan Greenspan highlighted the US government's willingness to curb spending and rising household savings as factors which may help to reduce it. In late trading in New York, the dollar reached $1.2871 against the euro, from $1.2974 on Thursday. Market concerns about the deficit has hit the greenback in recent months. On Friday, Federal Reserve chairman Mr Greenspan's speech in London ahead of the meeting of G7 finance ministers sent the dollar higher after it had earlier tumbled on the back of worse-than-expected US jobs data. "I think the chairman's taking a much more sanguine view on the current account deficit than he's taken for some time," said Robert Sinche, head of currency strategy at Bank of America in New York. "He's taking a longer-term view, laying out a set of conditions under which the current account deficit can improve this year and next."\n\nWorries about the deficit concerns about China do, however, remain. China's currency remains pegged to the dollar and the US currency's sharp falls in recent months have therefore made Chinese export prices highly competitive. But calls for a shift in Beijing's policy have fallen on deaf ears, despite recent comments in a major Chinese newspaper that the "time is ripe" for a loosening of the peg. The G7 meeting is thought unlikely to produce any meaningful movement in Chinese policy. In the meantime, the US Federal Reserve's decision on 2 February to boost interest rates by a quarter of a point - the sixth such move in as many months - has opened up a differential with European rates. The half-point window, some believe, could be enough to keep US assets looking more attractive, and could help prop up the dollar. The recent falls have partly been the result of big budget deficits, as well as the US's yawning current account gap, both of which need to be funded by the buying of US bonds and assets by foreign firms and governments. The White House will announce its budget on Monday, and many commentators believe the deficit will remain at close to half a trillion dollars.

## 3 Yukos unit buyer faces loan claim\n\nThe owners of embattled Russian oil giant Yukos are to ask the buyer of its former production unit to pay back a $900m (£479m) loan.\n\nState-owned Rosneft bought the Yugansk unit for $9.3bn in a sale forced by Russia to part settle a $27.5bn tax claim against Yukos. Yukos' owner Menatep Group says it will ask Rosneft to repay a loan that Yugansk had secured on its assets. Rosneft already faces a similar $540m repayment demand from foreign banks. Legal experts said Rosneft's purchase of Yugansk would include such obligations. "The pledged assets are with Rosneft, so it will have to pay real money to the creditors to avoid seizure of Yugansk assets," said Moscow-based US lawyer Jamie Firestone, who is not connected to the case. Menatep Group's managing director Tim Osborne told the Reuters news agency: "If they default, we will fight them where the rule of law exists under the international arbitration clauses of the credit."\n\nRosneft officials were unavailable for comment. But the company has said it intends to take action against Menatep to recover some of the tax claims and debts owed by Yugansk. Yukos had filed for bankruptcy protection in a US court in an attempt to prevent the forced sale of its main production arm. The sale went ahead in December and Yugansk was sold to a little-known shell company which in turn was bought by Rosneft. Yukos claims its downfall was punishment for the political ambitions of its founder Mikhail Khodorkovsky and has vowed to sue any participant in the sale.

## 4 High fuel prices hit BA's profits\n\nBritish Airways has blamed high fuel prices for a 40% drop in profits.\n\nReporting its results for the three months to 31 December 2004, the airline made a pre-tax profit of £75m ($141m) compared with £125m a year earlier. Rod Eddington, BA's chief executive, said the results were "respectable" in a third quarter when fuel costs rose by £106m or 47.3%. BA's profits were still better than market expectation of £59m, and it expects a rise in full-year revenues.\n\nTo help offset the increased price of aviation fuel, BA last year introduced a fuel surcharge for passengers.\n\nIn October, it increased this from £6 to £10 one-way for all long-haul flights, while the short-haul surcharge was raised from £2.50 to £4 a leg. Yet aviation analyst Mike Powell of Dresdner Kleinwort Wasserstein says BA's estimated annual surcharge revenues - £160m - will still be way short of its additional fuel costs - a predicted extra £250m. Turnover for the quarter was up 4.3% to £1.97bn, further benefiting from a rise in cargo revenue. Looking ahead to its full year results to March 2005, BA warned that yields - average revenues per passenger - were expected to decline as it continues to lower prices in the face of competition from low-cost carriers. However, it said sales would be better than previously forecast. "For the year to March 2005, the total revenue outlook is slightly better than previous guidance with a 3% to 3.5% improvement anticipated," BA chairman Martin Broughton said. BA had previously forecast a 2% to 3% rise in full-year revenue.\n\nIt also reported on Friday that passenger numbers rose 8.1% in January. Aviation analyst Nick Van den Brul of BNP Paribas described BA's latest quarterly results as "pretty modest". "It is quite good on the revenue side and it shows the impact of fuel surcharges and a positive cargo development, however, operating margins down and cost impact of fuel are very strong," he said. Since the 11 September 2001 attacks in the United States, BA has cut 13,000 jobs as part of a major cost-cutting drive. "Our focus remains on reducing controllable costs and debt whilst continuing to invest in our products," Mr Eddington said. "For example, we have taken delivery of six Airbus A321 aircraft and next month we will start further improvements to our Club World flat beds." BA's shares closed up four pence at 274.5 pence.

## 5 Pernod takeover talk lifts Domecq\n\nShares in UK drinks and food firm Allied Domecq have risen on speculation that it could be the target of a takeover by France's Pernod Ricard.\n\nReports in the Wall Street Journal and the Financial Times suggested that the French spirits firm is considering a bid, but has yet to contact its target. Allied Domecq shares in London rose 4% by 1200 GMT, while Pernod shares in Paris slipped 1.2%. Pernod said it was seeking acquisitions but refused to comment on specifics.\n\nPernod's last major purchase was a third of US giant Seagram in 2000, the move which propelled it into the global top three of drinks firms. The other two-thirds of Seagram was bought by market leader Diageo. In terms of market value, Pernod - at 7.5bn euros ($9.7bn) - is about 9% smaller than Allied Domecq, which has a capitalisation of £5.7bn ($10.7bn; 8.2bn euros). Last year Pernod tried to buy Glenmorangie, one of Scotland's premier whisky firms, but lost out to luxury goods firm LVMH. Pernod is home to brands including Chivas Regal Scotch whisky, Havana Club rum and Jacob's Creek wine. Allied Domecq's big names include Malibu rum, Courvoisier brandy, Stolichnaya vodka and Ballantine's whisky - as well as snack food chains such as Dunkin' Donuts and Baskin-Robbins ice cream. The WSJ said that the two were ripe for consolidation, having each dealt with problematic parts of their portfolio. Pernod has reduced the debt it took on to fund the Seagram purchase to just 1.8bn euros, while Allied has improved the performance of its fast-food chains.

## 6 Japan narrowly escapes recession\n\nJapan's economy teetered on the brink of a technical recession in the three months to September, figures show.\n\nRevised figures indicated growth of just 0.1% - and a similar-sized contraction in the previous quarter. On an annual basis, the data suggests annual growth of just 0.2%, suggesting a much more hesitant recovery than had previously been thought. A common technical definition of a recession is two successive quarters of negative growth.\n\nThe government was keen to play down the worrying implications of the data. "I maintain the view that Japan's economy remains in a minor adjustment phase in an upward climb, and we will monitor developments carefully," said economy minister Heizo Takenaka. But in the face of the strengthening yen making exports less competitive and indications of weakening economic conditions ahead, observers were less sanguine. "It's painting a picture of a recovery... much patchier than previously thought," said Paul Sheard, economist at Lehman Brothers in Tokyo. Improvements in the job market apparently have yet to feed through to domestic demand, with private consumption up just 0.2% in the third quarter.

## Category Complete_Filename

## 1 business 001.txt-business

## 2 business 002.txt-business

## 3 business 003.txt-business

## 4 business 004.txt-business

## 5 business 005.txt-business

## 6 business 006.txt-business- Find out about the name of the categories and the number of observations in each of them.

# list of the categories in the data set

unique(df_final$Category)## [1] "business" "entertainment" "politics" "sport"

## [5] "tech"table(df_final$Category)##

## business entertainment politics sport tech

## 510 386 417 511 401- Convert the data set into a document-term matrix using the function

DocumentTermMatrix()and subsequently use thefindFreqTerms()function to keep the terms which their frequency is larger than 10. A start of the code is given below. It is also a good idea to apply some text preprocessing, for this inspect thecontrolargument of the functionDocumentTermMatrix()(e.g., convert the words into lowercase, remove punctuations, numbers, stopwords, and whitespaces).

## set the seed to make your partition reproducible

set.seed(123)

df_final$Content <- iconv(df_final$Content, from = "UTF-8", to = "ASCII", sub = "")

docs <- Corpus(VectorSource(df_final$Content))

# alter the code from here onwards

dtm <- DocumentTermMatrix(...

))## set the seed to make your partition reproducible

set.seed(123)

df_final$Content <- iconv(df_final$Content, from = "UTF-8", to = "ASCII", sub = "")

docs <- Corpus(VectorSource(df_final$Content))

dtm <- DocumentTermMatrix(docs,

control = list(tolower = TRUE,

removeNumbers = TRUE,

removePunctuation = TRUE,

stopwords = TRUE

))

# words appearing more than 10x

features <- findFreqTerms(dtm, 10)

head(features)## [1] "accounts" "advert" "advertising" "alexander" "already"

## [6] "also"- Partition the original data into training and test sets with 80% for training and 20% for test.

## 80% of the sample size

smp_size <- floor(0.80 * nrow(df_final))

set.seed(123)

train_idx <- sample(seq_len(nrow(df_final)), size = smp_size)

# set for the original raw data

train1 <- df_final[train_idx,]

test1 <- df_final[-train_idx,]

# set for the cleaned-up data

train2 <- docs[train_idx]

test2 <- docs[-train_idx]- Create separate document-term matrices for the training and the test sets using the previous frequent terms as the input dictionary and convert them into data frames.

dtm_train <- DocumentTermMatrix(train2, list(dictionary = features))

dtm_test <- DocumentTermMatrix(test2, list(dictionary = features))

dtm_train <- as.data.frame(as.matrix(dtm_train))

dtm_test <- as.data.frame(as.matrix(dtm_test))- Use the

cbindfunction to add the categories to the train_dtm data and name the column cat.

dtm_train <- cbind(cat = factor(train1$Category), dtm_train)

dtm_test <- cbind(cat = factor(test1$Category), dtm_test)

dtm_train <- as.data.frame(dtm_train)

dtm_test <- as.data.frame(dtm_test)- Use the

rpart()function from therpartlibrary to fit a classification tree on the training data set. Evaluate your model on the training and test data. What is the accuracy of your model?

# here we fit a decision tree on the training data set

library(rpart)

fit_dt <- rpart(cat~., data = dtm_train, method = 'class')

# prediction on training data

pred_train <- predict(fit_dt, dtm_train, type = 'class')

fit_table <- table(dtm_train$cat, pred_train, dnn = c("Actual", "Predicted"))

fit_table## Predicted

## Actual business entertainment politics sport tech

## business 273 2 19 95 20

## entertainment 7 203 4 104 0

## politics 16 4 222 91 4

## sport 3 1 1 390 1

## tech 16 47 1 49 207# prediction on test data

pred_test <- predict(fit_dt, dtm_test, type = 'class')

fit_table_test <- table(dtm_test$cat, pred_test, dnn = c("Actual", "Predicted"))

fit_table_test## Predicted

## Actual business entertainment politics sport tech

## business 64 3 9 25 0

## entertainment 2 45 1 20 0

## politics 3 1 48 27 1

## sport 1 0 0 114 0

## tech 7 12 1 17 44# You can use this table to calculate Accuracy, Sensitivity, Specificity, Pos Pred Value, and Neg Pred Value. There are also many functions available for this purpose, for example the `confusionMatrix` function from the `caret` package.